“Imagine getting a washing machine delivered in 15 minutes,” said Bigbasket co-founder and CEO Hari Menon on the sidelines of a recent event. If the quick commerce (qCom) companies are to be believed, your next washing machine will be bought from the likes of Blinkit, Zepto, Instamart, and Bigbasket, rather than from the usual suspects like Flipkart and Amazon. Just as your sugar and salt can be delivered in under 15 minutes, these companies aim to deliver your washing machine ‘instantly’ as well.

One might wonder, who needs a washing machine instantly? But then again, we didn’t need our curd instantly either until a few years ago. The emergence of qCom identified this ‘need’ and is now raking in millions in sales. These qCom companies seem to understand our needs better than we do!

The eCommerce (eCom) giants Flipkart and Amazon are worried about the ambitions of the qCom players. They derive 40% of their revenues from the electronics category, which includes products like smartphones, mobile accessories, washing machines, TVs, and refrigerators. Flipkart is scrambling to build its own qCom business, while Amazon is aiming to acquire one. Both companies had previously dabbled in the qCom business but had shut it down. Now, they have no choice but to embrace qCom due to its rapid growth in India, which is threatening the existence of these eCom biggies.

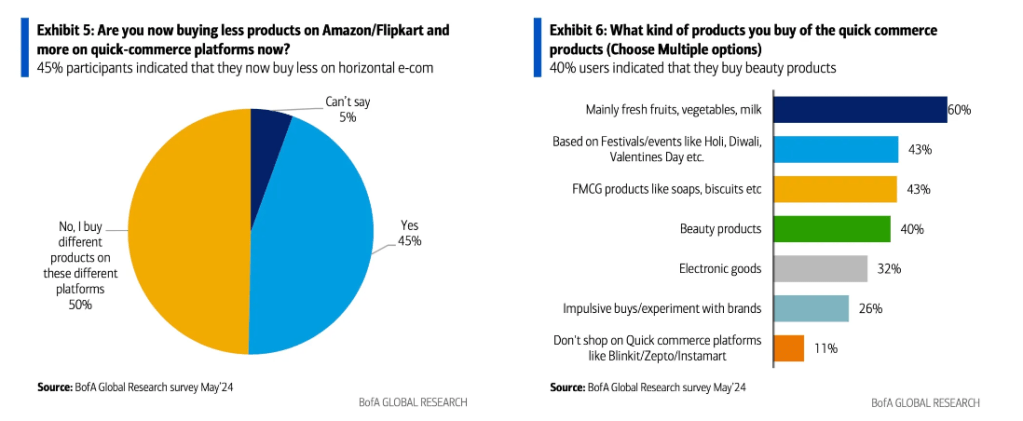

A recent consumer survey by Bank of America Global Research (BofA Global Research) in India found something interesting:

- 45% of participants said they are buying less on eCom majors and more from qCom companies.

- Consumers are not just shopping for their groceries on qCom platforms but also for electronics and beauty and personal care (BPC) products. 32% of participants said they use qCom to buy their electronics, and 40% for BPC products.

It’s clear why the eCom giants are sweating! They have already lost the groceries and food essentials war against qCom, and now they might lose their ‘bread and butter’ business too.

qCom companies are no longer younglings! These padawans are shaking the foundation of the original order of the digital commerce landscape in India. The OG disruptors of retail in India are at risk of getting disrupted themselves!

The gross merchandise value (GMV) of the qCom companies is growing at a breakneck speed. Market leaders Blinkit and Zepto have reported recent year GMVs exceeding INR 5,000 crore. They have only covered about 25 Indian cities thus far and have gone deeper in only 5-6 cities. The headroom available to these companies is huge! It’s not surprising that they aim to expand to 45-50 cities over the next two years. They have found huge success in the dark store model and are on a spree to expand their dark store network across the cities. They are chasing a bounty of USD 150 billion – the estimated addressable market of grocery and non-grocery qCom in the top 50 cities of India, according to Goldman Sachs.

qCom started with a simple use case of ‘low ticket-size X unplanned purchases’. Urban Indians do not want to store (buy in big packs), plan (bunch up purchases), travel to buy (invest time and money), and wait (for one day or more). This led to the rise of qCom.

From a modest average order value (AOV) of INR 200, the qCom majors have moved to INR 500 and above, but they want more – not only to grow but, more critically, to survive! They are looking for answers in adjacencies. Electronics like headphones have a higher ticket size as well as relatively better margins. The same is true for BPC products. These products aren’t necessarily within the construct of ‘low ticket size X unplanned purchase’, but qCom companies have found early success with them. They are beating Amazon and Flipkart in delivery timelines and are able to match the prices (and sometimes offer better pricing too). Why would a customer wait for two days to get boAt Wireless headphones if they can get them in 15 minutes? That’s their hypothesis, and they are proving it right. As things stand today, some of the best-selling headphones, chargers, and power banks on Amazon and Flipkart are already available on the qCom apps.

However, will they be able to replicate their success in large and bulky products like TVs, refrigerators, washing machines, and, to some extent, products like smartphones? This is another hypothesis that needs testing.

The electronics category isn’t just about forward delivery like groceries, where you deliver the product and forget about it. There are several other nuances, the key ones being:

- Product returns

- Warranties

- Financing (EMIs, card offers)

- Product exchange

- Installation

- After-sale service

- High storage space

- Last-mile delivery

Most of these elements require unique capabilities that qCom players are yet to develop and master. These capabilities require different types of expertise, which the eCom biggies have mastered over the past decades.

For instance, product returns are powered by a reverse workflow, which is as complex as the delivery workflow. This is also a significant operating expense, which can fully wipe out the high product margins of the electronics category.

Tata-backed Bigbasket is quite excited about the prospects of the electronics category. The company is working on a deal with Croma to bring the electronics selection to qCom.

If qCom players are to be believed, urban Indians may not even pre-plan the purchase of big-ticket items like TVs, refrigerators, smartphones, and washing machines. And there lies their next big opportunity to not only scale their business but also earn much-needed margins.

Our next washing machine may surely come from the likes of Zepto, Blinkit, or Bigbasket. This could happen as soon as the upcoming festive season starting in September 2024!

Discover more from On The Run with Aashu

Subscribe to get the latest posts sent to your email.

Leave a comment